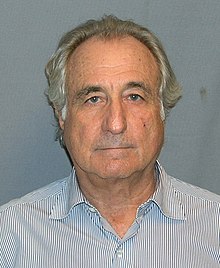

He founded the Wall Street firm Bernard L. Madoff Investment Securities LLC in 1960, and was its chairman until his arrest. Alerted by his sons, federal authorities arrested Madoff on December 11, 2008. On March 12, 2009, Madoff pleaded guilty to 11 federal crimes and admitted to operating what has been the largest Ponzi scheme in history.[citation needed] On June 29, 2009, he was sentenced to 150 years in prison with restitution of $170 billion. According to the original federal charges, Madoff said that his firm had "liabilities of approximately US$50 billion". Prosecutors estimated the size of the fraud to be $64.8 billion, based on the amounts in the accounts of Madoff's 4,800 clients as of November 30, 2008. Ignoring opportunity costs and taxes paid on fictitious profits, half of Madoff's direct investors lost no money.

Madoff's personal and business asset freeze has created a chain reaction throughout the world's business and philanthropic community, forcing many organizations to at least temporarily close, including the Robert I. Lappin Charitable Foundation, the Picower Foundation, and the JEHT Foundation.

Madoff started his firm in 1960 as a penny stock trader with $5,000 (about $35,000 in 2008 dollars), earned from working as a lifeguard and sprinkler installer. His fledgling business began to grow with the assistance of his father-in-law, accountant Saul Alpern, who referred a circle of friends and their families. Initially, the firm made markets (quoted bid and ask prices) via the National Quotation Bureau's Pink Sheets. In order to compete with firms that were members of the New York Stock Exchange trading on the stock exchange's floor, his firm began using innovative computer information technology to disseminate its quotes. After a trial run, the technology that the firm helped develop became the NASDAQ. At one point, Madoff Securities was the largest buying-and-selling "market maker" at the NASDAQ.

He was active in the National Association of Securities Dealers (NASD), a self-regulatory securities industry organization, serving as the Chairman of the Board of Directors and on the Board of Governors.

..."one of the masters of the off-exchange "third market" and the bane of the New York Stock Exchange. He has built a highly profitable securities firm, Bernard L. Madoff Investment Securities, which siphons a huge volume of stock trades away from the Big Board. The $740 million average daily volume of trades executed electronically by the Madoff firm off the exchange equals 9% of the New York exchange's. Mr. Madoff's firm can execute trades so quickly and cheaply that it actually pays other brokerage firms a penny a share to execute their customers' orders, profiting from the spread between bid and asked prices that most stocks trade for."

Several family members worked for him. His younger brother, Peter, was Senior Managing Director and Chief Compliance Officer, and Peter's daughter, Shana, was the compliance attorney. Madoff's sons, Mark and Andrew, worked in the trading section, along with Charles Weiner, Madoff's nephew.[citation needed] Andrew Madoff had invested his own money in his father's fund, but Mark stopped in about 2001.

Federal investigators believe the fraud in the investment management division and advisory division may have begun in the 1970s. However, Madoff himself stated his fraudulent activities began in the 1990s. In the 1980s, Madoff's market-maker division traded up to 5% of the total volume made on the New York Stock Exchange. Madoff was "the first prominent practitioner" who paid a broker to execute a customer's order through his brokerage, called a "legal kickback", which gave Madoff the reputation of being the largest dealer in NYSE-listed stocks in the U.S., trading about 15% of transaction volume. Academics have questioned the ethics of these payments. Madoff has argued that these payments did not alter the price that the customer received. He viewed the payments as a normal business practice: "If your girlfriend goes to buy stockings at a supermarket, the racks that display those stockings are usually paid for by the company that manufactured the stockings. Order flow is an issue that attracted a lot of attention but is grossly overrated." By 2000, Madoff Securities, one of the top traders of US securities, held approximately $300 million in assets. The business occupied three floors of the Lipstick Building, with the investment management division, referred to as the "hedge fund", employing a staff of approximately 24. Madoff ran a branch office in London, separate from Madoff Securities, which employed 28, handling investments for his family of approximately £80 million. Two remote cameras installed in the London office permitted Madoff to monitor events from New York.

Madoff's personal and business asset freeze has created a chain reaction throughout the world's business and philanthropic community, forcing many organizations to at least temporarily close, including the Robert I. Lappin Charitable Foundation, the Picower Foundation, and the JEHT Foundation.

Madoff started his firm in 1960 as a penny stock trader with $5,000 (about $35,000 in 2008 dollars), earned from working as a lifeguard and sprinkler installer. His fledgling business began to grow with the assistance of his father-in-law, accountant Saul Alpern, who referred a circle of friends and their families. Initially, the firm made markets (quoted bid and ask prices) via the National Quotation Bureau's Pink Sheets. In order to compete with firms that were members of the New York Stock Exchange trading on the stock exchange's floor, his firm began using innovative computer information technology to disseminate its quotes. After a trial run, the technology that the firm helped develop became the NASDAQ. At one point, Madoff Securities was the largest buying-and-selling "market maker" at the NASDAQ.

non-Madoff Ponzi Scheme | Madoff, 71 |  A full report on Bernard L. |  Ponzi Bernie Madoff Calls US |  billion Ponzi scheme. |

BY BERNIE MADOFF\x26#39;S "PONZI | Millions Look Up "Ponzi |  Bernie Madoff Ponzi scheme |  Bernard Madoff Pleads Guilty |  a Ponzi scheme. Wikipedia |

Several family members worked for him. His younger brother, Peter, was Senior Managing Director and Chief Compliance Officer, and Peter's daughter, Shana, was the compliance attorney. Madoff's sons, Mark and Andrew, worked in the trading section, along with Charles Weiner, Madoff's nephew.[citation needed] Andrew Madoff had invested his own money in his father's fund, but Mark stopped in about 2001.

Bernard Madoff. From Wikipedia |  Bernie Madoff |  see Bernard Madoff\x26#39;s Wikipedia |  Bernard Madoff in Bernard |  Bernie Madoff points out the |

FDR wasn\x26#39;t Bernie Madoff, |  Ponzi Scheme for Dummies by |  However, the financial scheme |  From jail, Madoff told the |  JR Martinez |

No comments:

Post a Comment